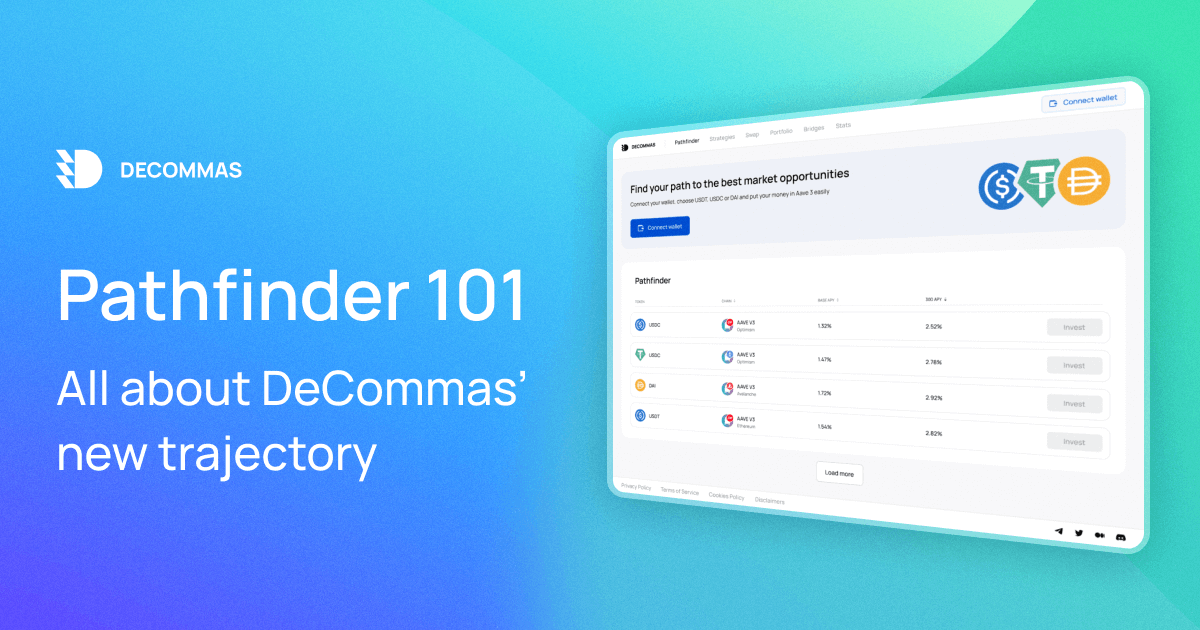

Pathfinder 101 - All about DeCommas’ new trajectory

The DeCommas team has kicked off 2023 on a very ambitious note, setting out on a mission to deliver the most user-friendly and comprehensive tool to navigate defi: a pathfinder that allows you to execute complex actions across multiple chains within one simple interface.

DeCommas has always had one clear vision for the project. We’re working hard each and every day to make defi accessible for the masses by creating user-friendly interfaces that allow for seamless cross-chain interactions. We believe this enables more people to benefit from the advantages defi has to offer, while opening up new opportunities for profitable cross-chain strategies.

In this article we’ll shed some light on the Pathfinder concept, and what’s in store for the next few months!

Pathfindooooor - What is it?

So let’s break this thing down. In essence Pathfinder algorithmically scouts routes to get from A to B within the realm of defi. Bridging, swapping, lending, borrowing, you name it. Anything that’s required to get you from point A to B as fast and cost-efficient as possible.

Think of Pathfinder as the SkyScanner for defi:

- You tell us where you are departing from and where you want to go, that could be a destination token/chain combination, or a more complex goal such as a delta neutral strategy.

- The algorithm looks for all the possible routes to get where you need to be, scanning multiple aggregators, bridges, exchanges and other protocols that might be required to get the job done.

- You get an easy to read interface displaying all the options to complete your journey, containing insights such as estimated “travel time” (how long it will take the algorithm to complete the task), estimated cost (gas and transaction fees for the route) and recommended options.

- See one you like? With the click of a few buttons you can execute the route. Pathfinder will take care of all the moving bits and pieces. You do not need to navigate to all individual protocol pages or smart contracts, that’s taken care of by your new best friend in defi.

Why does this matter? Opportunities don’t arise on just one chain, and are generally not achieved by just one transaction. The big brain transactions and strategies you want to be part of could be taking you 5 transactions in 3 different interfaces. Pathfinder makes that accessible within just one interface.

The first milestone - Pathfinder routes with LI.FI

The first partner we’ll be integrating into the pathfinder algorithms is none other than LI.FI. LI.FI aggregates a multitude of bridges and DEXes with a strong focus on security and reliability. When we’re pairing the outstanding LI.FI aggregation with the DeCommas Pathfinder algorithm, we get access to a wide array of options.

One of the first concepts we’re keen on is simple: get me from anywhere to the highest APY. With LI.FI facilitating swaps and bridges, we’ll hit multiple interesting routes. As an example, you might be looking for high APY opportunities on Arbitrum with a medium risk-profile. The results could be:

Beefy finance:

- wstETH-USDC LP: 26,1% (volatile)

- USDT LP on stargate: 7,2% (stable single asset pool)

- Curve MIM: 8,9% (stable LP pool)

GMX LPing:

- GLP: all time APR of 28% on pure GLP exposure

Curve.fi:

- TriCripto: 18% (Volatile, request of CRV staking for boost)

These simple examples are just a starting point. As time progresses, Pathfinder integrations and functionality will be expanded. Let’s take a look at some more advanced use cases one could think off:

- The Stargate farm on FRAX yields 10% APR on Avalanche, but you might want to minimize depeg risks and stay on USDC. Pathfinder would swap + bridge to Avalanche, supply USDC to Aave, borrow Frax -> Farm on Stargate. Now you’re getting access to that APR without fearing any depeg.

- Let’s take a look at the GMX ecosystem. Pathfinder could deliver a GLP hedged strategy, where you like GLP exposure and APR, but you want to hedge the majority of the downside. Pathfinder helps you swap + bridge to Arbitrum, buy & stake GLP, hedge the ETH and BTC exposure on the platform of instrument of your choice.

- Looking for basis arbitrage or funding rate farming? Pathfinder onboards you to the chain of the arbitrage opportunity, open asset X long on one platform and short on the other. Pathfinder would exit as the arbitrage opportunity is no longer there, and would repeat the process when the conditions are right.

That’s just a glimpse of the variety of what could be built as a part of the concept and also addresses how it’s a continuation of groundwork and research that was done in 2022.

In the future it could take pool capacity, liquidity situation and cooldown periods of staking into account as well. It could even go further, and handle creation of leverage or delta-neutral routes depending on the conditions of your request.

You’ll be able to access these routes all from within the Pathfinder interface, no matter the asset you want to use to gain access. Are you starting to understand why we’re so enthusiastic about the Pathfinder concept?

A first glance at the roadmap for Pathfinder

The good old roadmap, a staple of defi- and crypto projects in general. While above should be enough to get you excited, we can show you a few milestones we’ll be working towards in 2023 with DeCommas Pathfinder.

Q1 2023

- LI.FI integration -> LI.FI integration is being built, expect this in February, together with exciting joint marketing efforts and a Q&A with the team.

- Pathfinder MVP live -> As LI.FI integration is done, first pathfinder routes will be deployed as MVP, and first routes to Aave will be made available

- Cross-chain swap rework & integration with bridges -> Current swap and bridges products will be integrated in to the Pathfinder interface

- Groundwork for complex strategies in Pathfinder -> We build the foundation for complex strategies within Pathfinder, such as the Delta Neutral PERP-ETH-MAINNET strategy you see on the DeCommas app now!

Q2 2023

We won’t spoil just too much about what Q2 might look like. Here are a few concepts we will be working on:

- Capital markets (money markets) module in Pathfinder

- Yield aggregators in Pathfinder

- Leveraged liquidity farming in Pathfinder

- Automated strategies in Pathfinder

- Advanced analytics in portfolio

Wen MVP you ask? We’re looking at a timeline of 3-4 weeks from today, so stay tuned. As always, join us on Discord and follow us on Twitter to be the first to know.

Ps. Community Rewards soon!